How can short term financing help a business?

What exactly is a short-term business loan and how can short-term financing help a business? Managing cash flow is a perpetual challenge for anyone running a business. If you manage a small or medium-sized business there are a range of hazards, delays and problems that can mean you experience a temporary shortfall in income. From […]

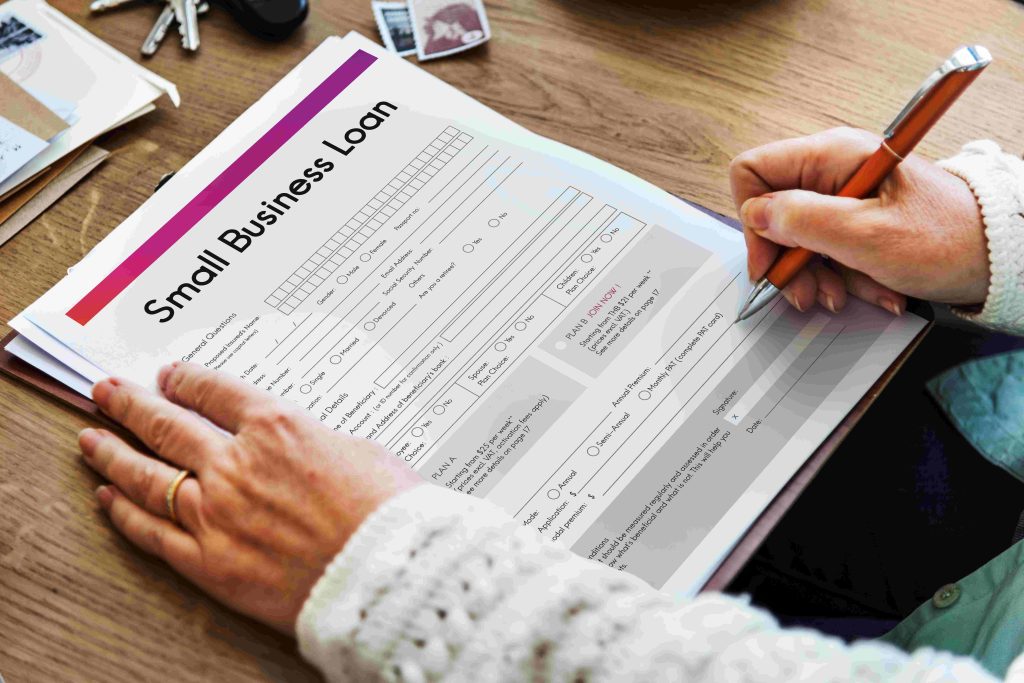

How can I apply for a short-term business loan?

Get your loan today If you’re running a business, managing cash flow and ensuring you have adequate funds to cover costs, seize opportunities and cope with unexpected emergencies is a key concern. Without the necessary funds when you need them the long-term success of your business may not be guaranteed. At some point, most businesses […]

How long do you have to pay off a short-term business loan?

Get your loan today As a general rule, short-term business loans must be repaid within 5 years. This means that if you’re looking for a longer-term finance arrangement, you may need to explore other options. If you’re currently exploring your business finance options, then the length of time you have to pay back a loan […]

Why would a business need short-term finance?

Get your loan today Why would a business need short-term finance and what are the pros and cons of this kind of finance? Short-term business finance is a flexible option when a business needs a quick injection of capital. They are generally quick to arrange, have flexible repayment terms and can be structured for different […]

Is a short-term loan for a startup business good?

Get your loan today Short-term loans for startup business are often part of the funding mix for new businesses. If you’re launching a new business your finances will be a key concern. You can have a great product or service and brilliant marketing ideas, but if you don’t have sufficient capital your business is unlikely […]

How can I get a short-term unsecured business loan?

Get your loan today If you’re looking for extra capital for your business, a short-term unsecured business loan may be the answer. They are flexible, easy to access loans that give business owners the capital they need, when they need it. Business owners will typically take out unsecured business loans for a variety of reasons. […]

Are short-term business loan rates higher than regular loans?

Get your loan today Before taking out a loan it’s important to consider short-term business loan rates. These can vary considerably but will usually be higher than longer-term financing options. Short term business loans provide a quick and accessible means for businesses to access extra capital. They can cater for the urgent financial requirements of […]

Short-term sources of finance for small businesses

Get your loan today What kind of short-term sources of finance for small business options are available and how can you find the right short-term finance option to meet your company’s particular needs? Cash flow is the lifeblood of business, but even with the best financial planning, unexpected events and expenses can cause problems. Ensuring your […]

Are short-term loans working capital loans?

Get your loan today A short-term working capital loan helps businesses manage cash flow fluctuations, especially during periods of increased expenses or delayed customer payments. Managing cash flow is crucial for the financial stability of any business. It provides the necessary buffer to bridge a gap between outgoing and incoming cash, ensuring that the business […]

Are short-term loans for a small business good?

Get your loan today When investigating lenders and comparing loans for a small business, you may have encountered both long and short-term loans on offer. The differences between the two products can often make it hard to understand which is best. Are short-term loans for a small business good, and what do you need to […]

How can I get a short-term business cash flow loan?

Get your loan today A business cash flow loan can be an ideal solution for businesses, and for a business that can rely on its cash flow in the near future, they just make sense. Not all cash problems for businesses are the same. Sometimes, a short-term fix is all that’s needed without involving banks […]

What are the different types of short-term small business loans?

Get your loan today A short-term small business loan can vary in how it is structured by lenders and how they might suit the businesses taking them out. ‘Short-term’ is a phrase that only describes the length of time over which a borrower pays back a loan. Short-term small business loans come in several forms, […]